Blog

MIRAI corporation Real Estate Investment

- 2019-09-05

- Traiding Idea

MIRAI is a diversified J-REIT sponsored by Mitsui & Co., one of Japan's leading conglomerates, and IDERA Capital Management Ltd., which has extensive investment experience as an independent asset management company. MIRAI Corporation operates as a real estate investment trust. The Company invests in office and commercial buildings and hotels. MIRAI serves customers in Japan.

Scope of Business: invest in real estates

Listed on: Tokyo Stock Exchange First Section

(Securities code:3476)

Founded:

November 2015

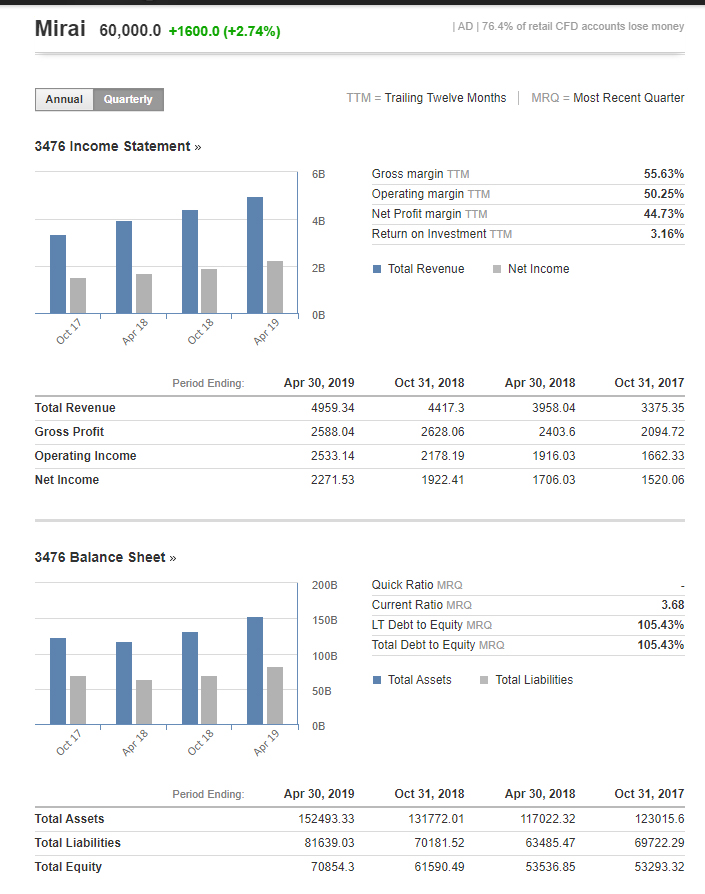

Financial Data:

For the six months ended 30 April 2019, Mirai Corp revenues increased 25% to Y4.96B. Net income applicable to common stockholders increased 33% to Y2.27B. Revenues reflect Lease business revenue increase of 34% to Y4.02B, Other lease business revenue increase of 13% to Y935.7M. Net income benefited from Loss on reduction of non-current assets decrease of 84% to Y24.7M (expense), Other Operating Expense decrease of 44% to Y38.3M (expense).

Technical Analysis:

First of all we have an upward trend for MIRAI Corp. chart. the price is at the momemt in Sniper position, so price is above exponential moving avererage 20 , 50, 100, 200, in all time frames daily, H4, H1, M30, M15 . in Daily chart MACD histogram is above of Zero level and its volumes are increasing. The second Reason the price is from middle of july in an Ascending Triangle and Compressing for an impulse movement. The price has been breaked the Resistance area with two full body candles.

Elliot waves:

On the Weekly chart, an upward wave developed and the price is completing wave (3). 161.8% fibonacci of wave (1) is the next target of price. the wave 3 could be ended at this Level. and begun a correction for wave (4).

Trading Tips:

To open long positions, one could waiting for pullback on the support Area (Blue line) or R1 monthly and then open the long position.

TP1 : on R3 Monthly @ 61072

TP2 : end of Elliot impulse wave 3 @ 62550